31 Oct Use Your HSA or FSA Funds for 3G Cardio Equipment: Save 30% on Your Health Investment

The fitness equipment industry has conditioned consumers to accept two expensive realities: paying thousands upfront for equipment, then paying monthly subscriptions to actually use what you already bought. We challenged the subscription model by building equipment with FreeSync™ FTMS Bluetooth that works with any app you choose, no monthly fees required. Now there’s another way to make your fitness investment smarter: using your Health Savings Account or Flexible Spending Account funds to purchase commercial-grade equipment with pre-tax dollars.

Through our partnership with Flex, you can use HSA or FSA funds to purchase 3G Cardio equipment and save between 20% and 40% on your investment depending on your tax bracket. Our complete lineup qualifies when medical necessity is established, including treadmills, bikes, ellipticals, stair steppers, and vibration trainers. That’s not a promotional discount that expires or a limited-time sale with artificial urgency. That’s the permanent tax advantage of using pre-tax healthcare dollars for equipment that qualifies as a legitimate health expense when prescribed for medical necessity.

Understanding the HSA and FSA Advantage for Fitness Equipment

When you purchase fitness equipment with regular income, you’re spending money that’s already been taxed. Your paycheck gets reduced by federal income tax, state income tax where applicable, Social Security, and Medicare before you ever see it. Then you spend what’s left on a treadmill or recumbent bike. With HSA and FSA funds, you’re spending money before those taxes get taken out, which means more purchasing power for the same amount of work.

Most Americans save between 20% and 40% when using HSA or FSA funds instead of post-tax dollars, depending on their federal tax bracket plus FICA taxes (Social Security 6.2% and Medicare 1.45%). Someone in the common 22% federal tax bracket saves approximately 30% total (22% + 7.65% FICA). For a commercial-grade treadmill that would cost you $4,000 in post-tax income, you might only need around $2,400 to $3,200 in HSA or FSA funds to make the same purchase. That difference represents real money staying in your account instead of going to tax obligations.

The Internal Revenue Service allows HSA and FSA funds for qualified medical expenses, which includes fitness equipment when it’s deemed medically necessary by a licensed healthcare provider through a Letter of Medical Necessity. Eligibility is determined by the medical documentation proving that a healthcare provider prescribed the equipment for treating or preventing a specific diagnosed medical condition. Treadmills, recumbent bikes, ellipticals, and other cardio equipment can all qualify when properly prescribed for cardiovascular health, weight management, joint rehabilitation, diabetes management, and dozens of other medical conditions.

How the Flex Partnership Makes This Process Simple

We partnered with Flex because they solved the compliance challenge that traditionally made HSA and FSA purchases complicated. The IRS requires documentation proving medical necessity before you can use healthcare funds for fitness equipment. That used to mean scheduling a doctor’s appointment, explaining what you wanted to buy, getting a letter of medical necessity, submitting paperwork to your HSA or FSA administrator, and waiting for reimbursement approval. Flex streamlined this entire process into something that happens during checkout.

When you select Flex as your payment option at checkout, you’ll complete a brief health questionnaire that takes just a few minutes. This questionnaire asks about relevant health conditions and fitness goals that might qualify your purchase as medically necessary. Flex’s medical team reviews your responses, and if your purchase qualifies, they issue a Letter of Medical Necessity directly to you via email. For eligible purchases, this happens quickly enough that you can complete your transaction without delays.

The Letter of Medical Necessity serves as your documentation proving that a licensed healthcare provider has determined your fitness equipment purchase addresses a legitimate medical need. This isn’t a workaround or a technicality. It’s the proper process for ensuring that HSA and FSA funds get used according to IRS guidelines while making that process efficient enough that you don’t need separate doctor’s appointments and weeks of paperwork.

Two Ways to Use Your HSA or FSA Funds

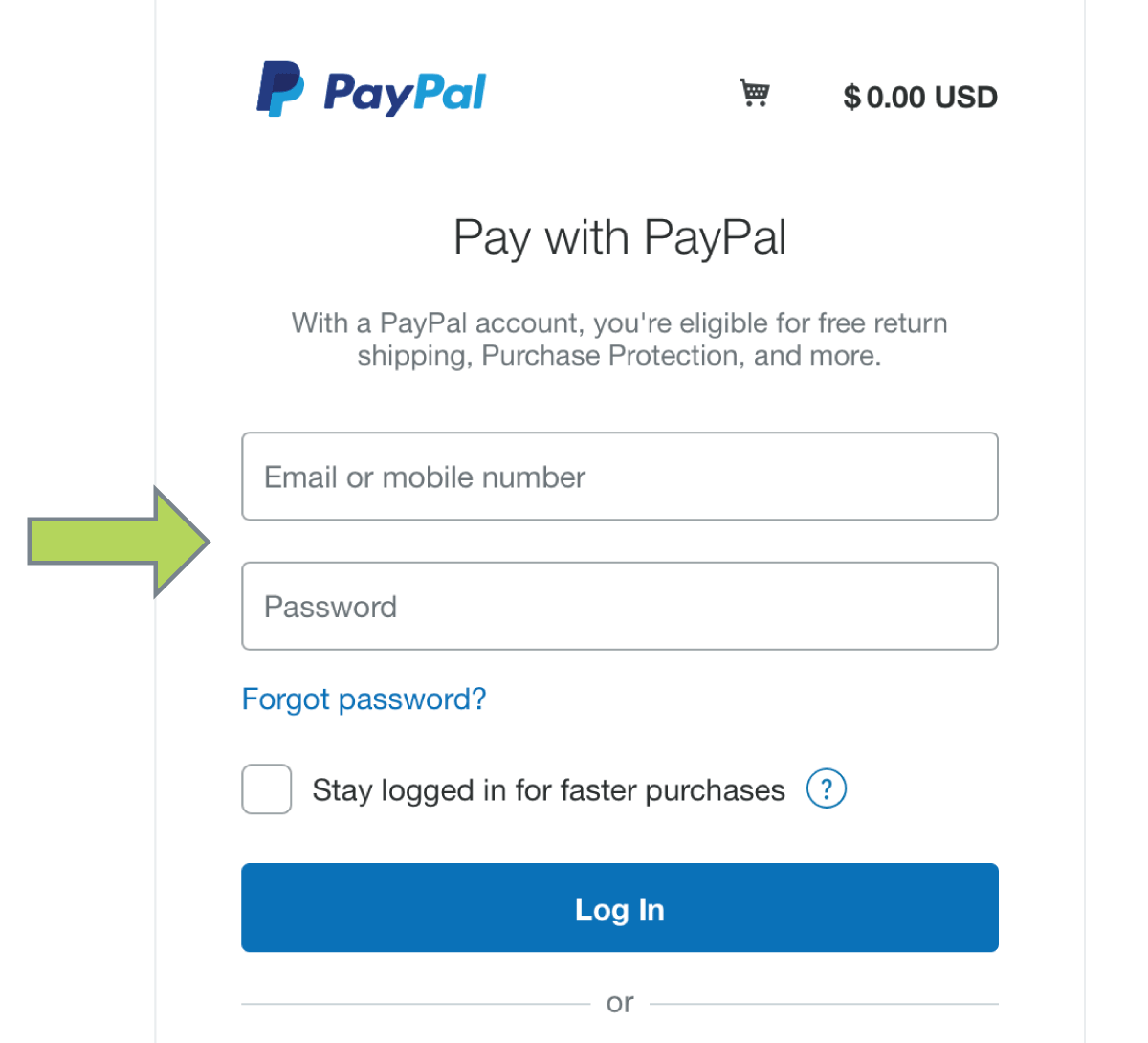

Flex supports two different payment approaches depending on your preference and your specific HSA or FSA account type. The direct payment method lets you use your HSA or FSA card right at checkout. After completing the health questionnaire and receiving confirmation that your purchase qualifies, you can enter your HSA or FSA debit card information and complete the transaction just like any other purchase. Your healthcare account gets charged directly, the tax savings apply automatically, and you’re done.

The reimbursement method works when you prefer to use a regular credit or debit card for the initial purchase. You complete your order with standard payment, then fill out the same health questionnaire. If your purchase qualifies, Flex sends you the Letter of Medical Necessity along with instructions for submitting a reimbursement claim to your HSA or FSA administrator. Most reimbursement claims process within 2 to 4 weeks, depending on your specific plan administrator. This approach works well if you’re using a credit card that offers rewards points, or if your HSA or FSA debit card has transaction limits that wouldn’t cover the full purchase amount.

Both methods provide the same tax savings. The difference is just timing and convenience based on your situation. Direct payment saves you from fronting the full cost, while reimbursement gives you flexibility in how you initially fund the purchase while still getting your tax advantage back.

What Equipment Qualifies for HSA and FSA Use

The IRS doesn’t maintain a specific list of approved fitness equipment for HSA and FSA use. Instead, eligibility depends entirely on whether the equipment serves a legitimate medical purpose as determined by a licensed healthcare provider through a Letter of Medical Necessity. General recreational fitness equipment purchased purely for aesthetic goals typically won’t qualify. Equipment prescribed for managing specific health conditions, supporting rehabilitation, enabling cardiovascular health improvement, or addressing mobility limitations generally does qualify when properly documented.

When a healthcare provider prescribes fitness equipment for someone managing obesity, diabetes, cardiovascular disease, joint issues, or similar conditions, they’re prescribing medical intervention tools. The IRS requirements focus on medical necessity documentation, not on equipment specifications or price. A basic treadmill with a Letter of Medical Necessity holds the same eligibility status as premium equipment with the same documentation. What matters is that a licensed healthcare provider has determined your specific health condition requires home exercise equipment as part of your treatment plan.

Our Elite Runner X treadmill with its 4.0 horsepower motor and commercial-grade belt system can handle intensive rehabilitation protocols and sustained cardiovascular training. The Elite RB X recumbent bike with its ergonomic seat design and adjustability works for users with limited mobility or joint issues who need low-impact cardiovascular exercise options. These engineering decisions make equipment more effective for long-term medical use, but HSA and FSA eligibility is determined by your Letter of Medical Necessity, not by equipment specifications.

The Subscription-Free Advantage Still Applies

Using HSA or FSA funds provides significant savings on your initial equipment purchase, but the long-term value equation includes what happens after that purchase. Many fitness equipment brands that offer HSA and FSA purchasing options then lock you into monthly subscription fees to access workout programs, performance tracking, or even basic functionality. You save 20% to 40% upfront through tax advantages, then spend $40 to $60 monthly for years to actually use what you bought.

Every piece of 3G Cardio equipment includes FreeSync™ FTMS Bluetooth technology that connects to any compatible fitness app, streaming service, or device you choose without requiring our permission or a subscription fee. Use Zwift for virtual cycling, connect to Peloton’s app if you want their classes, stream Netflix during cardio sessions, or use nothing at all beyond the equipment’s built-in programs. Your health savings from using HSA or FSA funds remain health savings instead of getting gradually consumed by subscription fees.

Over a 10-year equipment lifespan, subscription fees of $45 monthly total $5,400. If you saved $1,200 using HSA funds on your initial purchase but then paid $5,400 in subscriptions, your net position is negative $4,200 compared to buying subscription-free equipment. The tax advantage is real and valuable, but it compounds when paired with equipment that doesn’t create ongoing payment obligations.

Getting Started With Your HSA or FSA Purchase

When you’re ready to use your HSA or FSA funds for 3G Cardio equipment, the process starts at our website where you can explore our full equipment lineup and specifications. Each product page includes complete technical details, capacity ratings, warranty information, and the engineering explanations for why we built specific features the way we did. Understanding what you’re buying and why it’s constructed that way helps during the health questionnaire process when you’ll explain to Flex’s medical team how the equipment addresses your health needs.

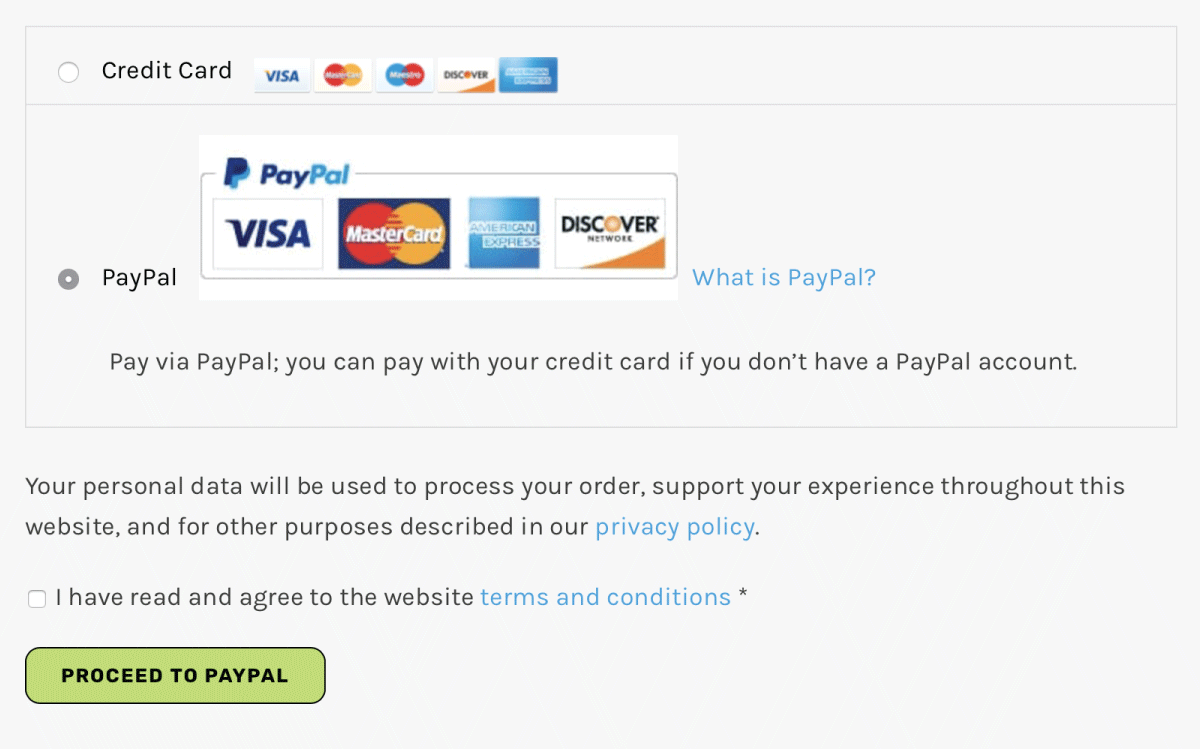

During checkout, you’ll see Flex as a payment option alongside standard credit card and financing choices. Selecting Flex initiates the health questionnaire process. Answer the questions accurately and completely; the medical team needs sufficient information to determine whether your purchase qualifies as medically necessary under IRS guidelines. If you’re working with a physician who has already recommended home exercise equipment, mention that. If you have specific health conditions that prescribed exercise helps manage, provide those details. The more context you provide about legitimate medical needs, the more effectively the medical team can evaluate your eligibility.

Once you receive your Letter of Medical Necessity confirmation, you can complete your purchase using either the direct payment method with your HSA or FSA card, or the reimbursement method with a regular payment card followed by claim submission. Flex provides clear instructions for whichever method you choose. If you have questions during the process, our customer service team at 1-888-888-7985 can help with equipment selection and ordering questions, while Flex’s support team handles questions about the qualification process and HSA or FSA mechanics.

Your equipment ships directly from our facility with white-glove delivery options available depending on your location. Because we manufacture and sell directly, we control the entire process from production through delivery and setup. Our customer service team knows the equipment thoroughly because they work for the company that builds it, not a third-party retailer reading from scripts. That direct relationship continues throughout your ownership with warranty support, technical assistance, and replacement parts if you ever need them.

Making Your Investment Decision

The combination of commercial-grade construction, FreeSync™ FTMS Bluetooth freedom from subscriptions, and HSA or FSA tax advantages creates a value equation worth examining carefully when you’re comparing equipment options. Any fitness equipment can qualify for HSA or FSA purchasing with proper medical documentation, regardless of price or specifications. The question becomes whether you want equipment built to last for years of consistent medical use, or equipment that might need replacement before you’ve achieved your long-term health goals.

Equipment built to 400 pound capacity with lifetime frame warranties, commercial-grade motors, and proper ergonomic design costs more initially than consumer-grade alternatives because the engineering and component quality genuinely differ. When you can purchase that commercial-grade equipment with pre-tax HSA or FSA dollars, saving 20% to 40% depending on your tax bracket, then use it for 10+ years without subscription fees while it maintains performance because it was overbuilt from the start, the math changes considerably.

We price our equipment at manufacturer-direct levels without retail markup because we sell directly to customers instead of through dealer networks. We don’t mark it up to mark it down with fake sales and artificial urgency. The prices you see reflect what it actually costs to build commercial-grade equipment with proper components, reasonable margins, and direct customer support. When you apply HSA or FSA tax savings to manufacturer-direct pricing, you’re getting commercial quality at what consumer-grade equipment would cost with post-tax dollars.

Using HSA or FSA funds for fitness equipment represents a decision to treat home exercise equipment as legitimate health infrastructure rather than optional recreational purchases. When you frame the decision that way, equipment quality, durability, and long-term usability become primary considerations rather than secondary features. Equipment that’s supporting your cardiovascular health, managing your diabetes, facilitating your joint rehabilitation, or enabling your mobility needs to function reliably for years without degradation, which is why we engineer our equipment to commercial standards.

Tax savings of 20% to 40% from using pre-tax healthcare dollars provides immediate financial advantage, but the real return on investment comes from years of consistent use because the equipment remains comfortable, stable, and functional. Treadmills that develop belt slippage, bikes with seats that cause discomfort after 20 minutes, or ellipticals that wobble under load discourage consistent use. Equipment you actually use because it works properly delivers the health outcomes that justified the HSA or FSA purchase in the first place.

We built our equipment to commercial standards specifically because home users deserve the same quality that gyms and rehabilitation facilities demand. HSA and FSA eligibility is determined by your Letter of Medical Necessity from a healthcare provider, not by equipment grade or price. You get equipment that lasts because it’s overbuilt where it matters, and you can use tax-advantaged healthcare funding to purchase it when your healthcare provider determines it’s medically necessary for your treatment plan.

*Savings based on qualified purchases with Letter of Medical Necessity for customers in the 22% federal tax bracket. Actual savings range from 20% to 40% depending on individual tax bracket and FICA taxes. HSA/FSA eligibility determined by licensed healthcare provider.

When you’re ready to experience the 3G Cardio difference, call us directly at 1-888-888-7985 for immediate assistance from our team.

Visit 3GCardio.com to explore our full range of commercial-grade fitness equipment and experience fitness equipment ownership without subscriptions, without complications, just quality that works exactly as it should.

Sorry, the comment form is closed at this time.