31 Oct Flex

How the Flex Partnership Makes This Process Simple

We partnered with Flex because they solved the compliance challenge that traditionally made HSA and FSA purchases complicated. The IRS requires documentation proving medical necessity before you can use healthcare funds for fitness equipment. That used to mean scheduling a doctor’s appointment, explaining what you wanted to buy, getting a letter of medical necessity, submitting paperwork to your HSA or FSA administrator, and waiting for reimbursement approval. Flex streamlined this entire process into something that happens during checkout.

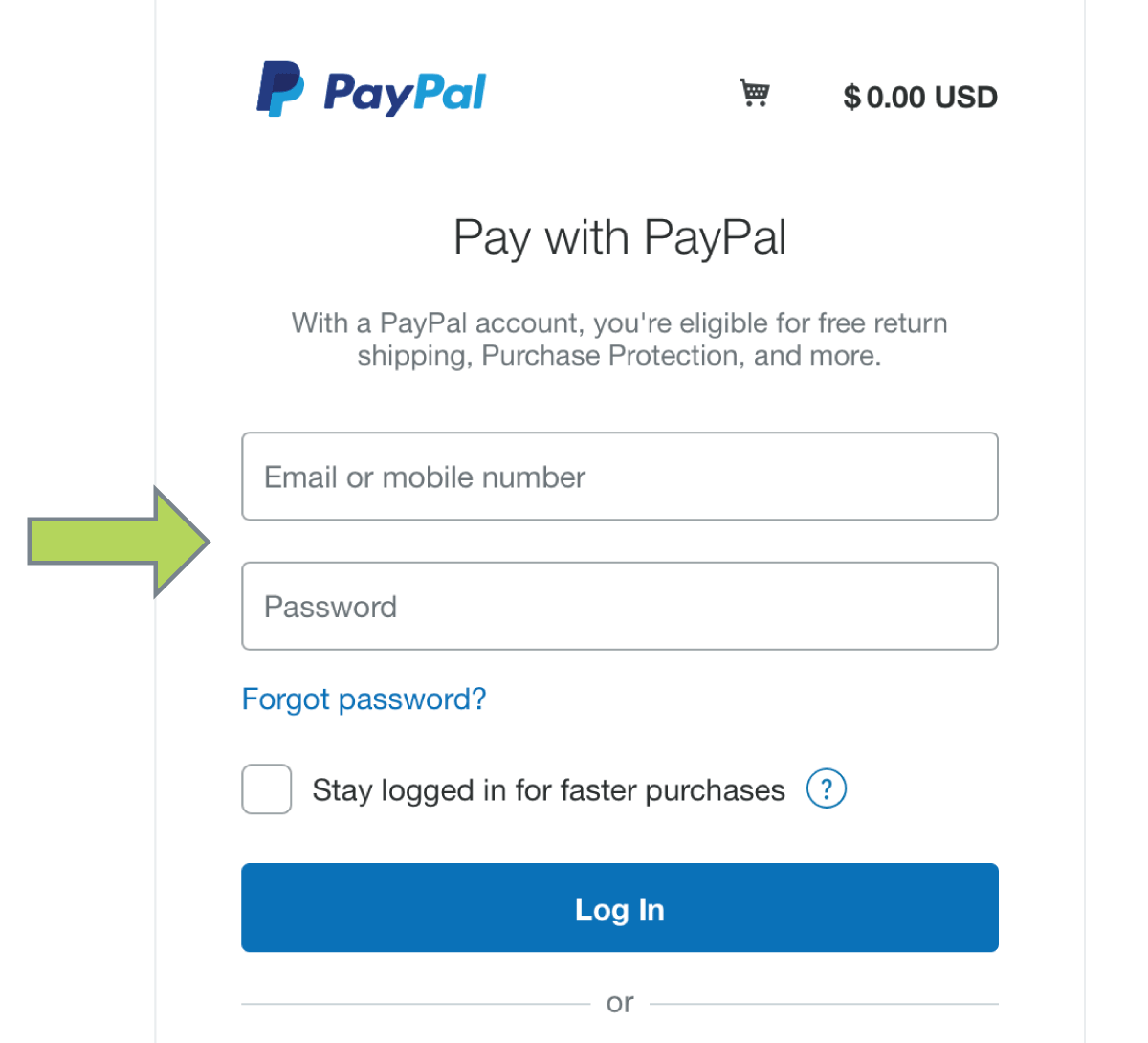

When you select Flex as your payment option at checkout, you’ll complete a brief health questionnaire that takes just a few minutes. This questionnaire asks about relevant health conditions and fitness goals that might qualify your purchase as medically necessary. Flex’s medical team reviews your responses, and if your purchase qualifies, they issue a Letter of Medical Necessity directly to you via email. For eligible purchases, this happens quickly enough that you can complete your transaction without delays.

The Letter of Medical Necessity serves as your documentation proving that a licensed healthcare provider has determined your fitness equipment purchase addresses a legitimate medical need. This isn’t a workaround or a technicality. It’s the proper process for ensuring that HSA and FSA funds get used according to IRS guidelines while making that process efficient enough that you don’t need separate doctor’s appointments and weeks of paperwork.

Two Ways to Use Your HSA or FSA Funds

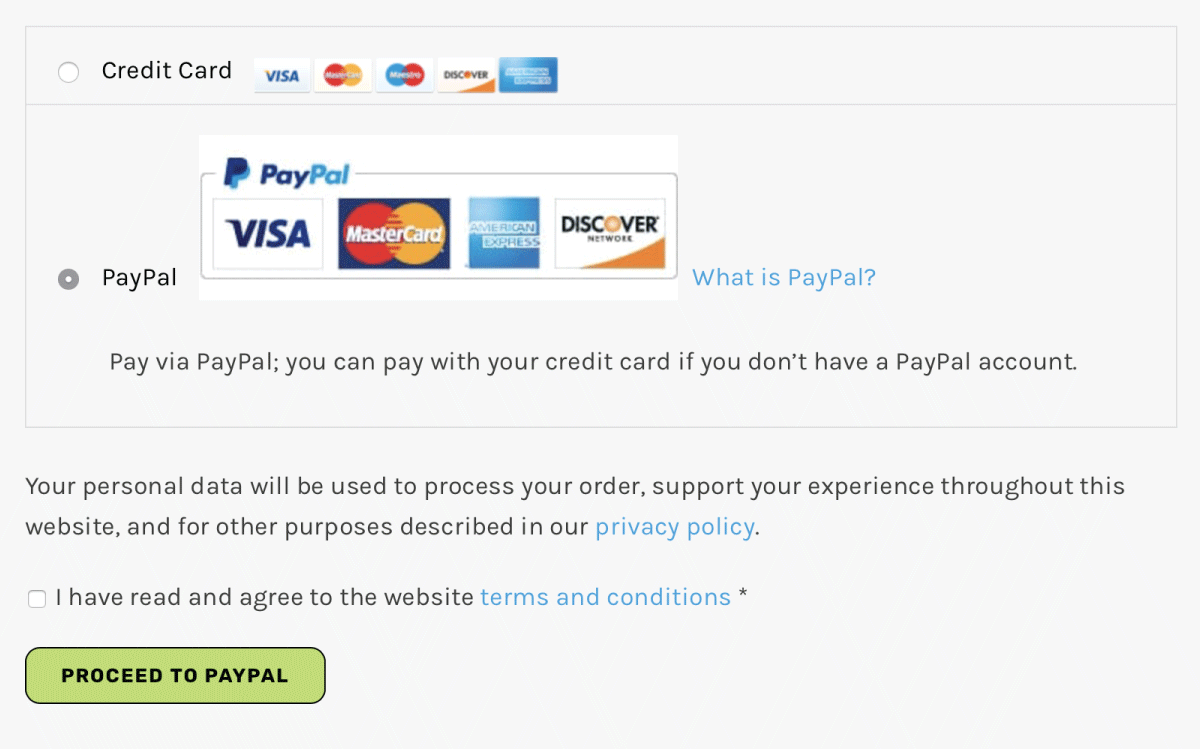

Flex supports two different payment approaches depending on your preference and your specific HSA or FSA account type. The direct payment method lets you use your HSA or FSA card right at checkout. After completing the health questionnaire and receiving confirmation that your purchase qualifies, you can enter your HSA or FSA debit card information and complete the transaction just like any other purchase. Your healthcare account gets charged directly, the tax savings apply automatically, and you’re done.

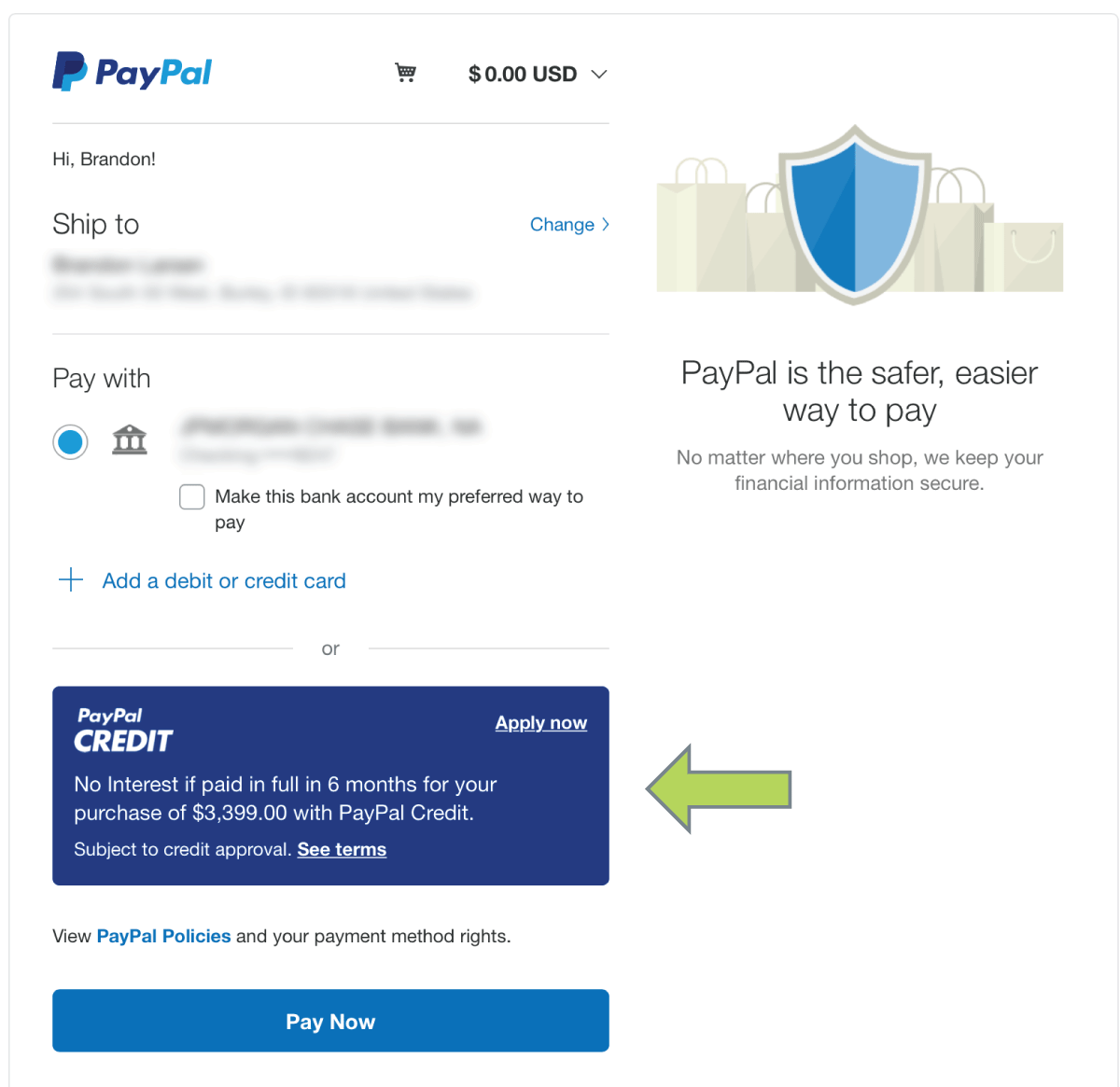

The reimbursement method works when you prefer to use a regular credit or debit card for the initial purchase. You complete your order with standard payment, then fill out the same health questionnaire. If your purchase qualifies, Flex sends you the Letter of Medical Necessity along with instructions for submitting a reimbursement claim to your HSA or FSA administrator. Most reimbursement claims process within 2 to 4 weeks, depending on your specific plan administrator. This approach works well if you’re using a credit card that offers rewards points, or if your HSA or FSA debit card has transaction limits that wouldn’t cover the full purchase amount.

Both methods provide the same tax savings. The difference is just timing and convenience based on your situation. Direct payment saves you from fronting the full cost, while reimbursement gives you flexibility in how you initially fund the purchase while still getting your tax advantage back.

No Comments