Using Health Savings Account or Flexible Spending Account funds for fitness equipment provides significant tax advantages, but the process involves specific compliance requirements and deadlines that account holders need to understand. The Internal Revenue Service establishes clear guidelines about what constitutes qualified medical expenses, and understanding these rules protects your account from penalties while ensuring you maximize your healthcare dollars effectively.

This guide addresses the compliance requirements, documentation standards, eligibility criteria, and common questions surrounding HSA and FSA purchases for fitness equipment. Whether you’re approaching an FSA deadline, evaluating equipment options, or navigating the reimbursement process, understanding these details helps you make informed decisions about using tax-advantaged healthcare funds for commercial-grade fitness equipment.

IRS Compliance and Documentation Requirements

The Internal Revenue Service defines qualified medical expenses in Publication 502 as costs for diagnosis, cure, mitigation, treatment, or prevention of disease, and for affecting any part or function of the body. This definition extends beyond explicitly listed items to include equipment and supplies when a licensed healthcare provider determines medical necessity. The IRS doesn’t maintain an exhaustive list of every eligible product because medical circumstances vary by individual, which is why the Letter of Medical Necessity process exists.

When you purchase fitness equipment using HSA or FSA funds through Flex, the transaction meets IRS substantiation requirements through real-time eligibility verification and proper documentation. Flex’s system confirms that your purchase qualifies as a medical expense under IRS guidelines, issues appropriate documentation, and maintains records according to regulatory requirements. You should keep your Letter of Medical Necessity and itemized receipt for at least 3 years as the IRS recommends in Publication 969, which states that account holders must maintain records sufficient to demonstrate that distributions were exclusively for qualified medical expenses.

The substantiation process protects both you and your HSA or FSA account from compliance issues. Without proper documentation, the IRS may apply a 20% penalty to the value of purchases that can’t be demonstrated as eligible medical expenses. This is why working through Flex’s established process matters beyond just convenience. The system ensures that every purchase includes the documentation required to satisfy IRS audit requirements should your account ever be reviewed.

Understanding Eligibility Requirements

While Flex makes the qualification process straightforward, HSA and FSA eligibility isn’t universal for all purchases or all people. Equipment must be prescribed for medical necessity, not general fitness or aesthetic goals. If the health questionnaire reveals that your primary goal is recreational fitness without underlying health conditions that would benefit from prescribed exercise equipment, your purchase likely won’t qualify for HSA or FSA use. This isn’t Flex being restrictive; it’s the IRS establishing clear guidelines about what constitutes qualified medical expenses.

Common qualifying conditions include cardiovascular disease management, diabetes treatment, obesity intervention, joint rehabilitation, mobility limitation accommodation, prescribed physical therapy protocols, and similar medically documented needs. If you’re working with a physician who has recommended home exercise equipment as part of a treatment plan, you’re likely to qualify. If you simply want to get in better shape without specific medical necessity, standard payment methods remain available.

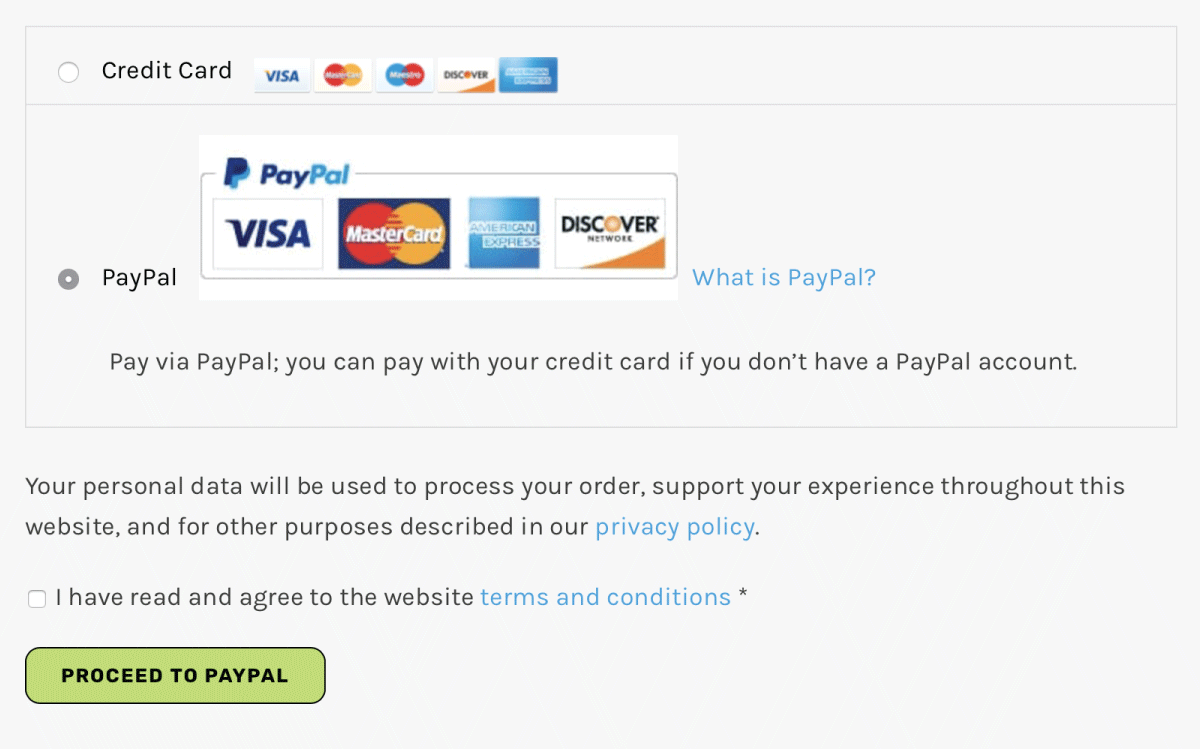

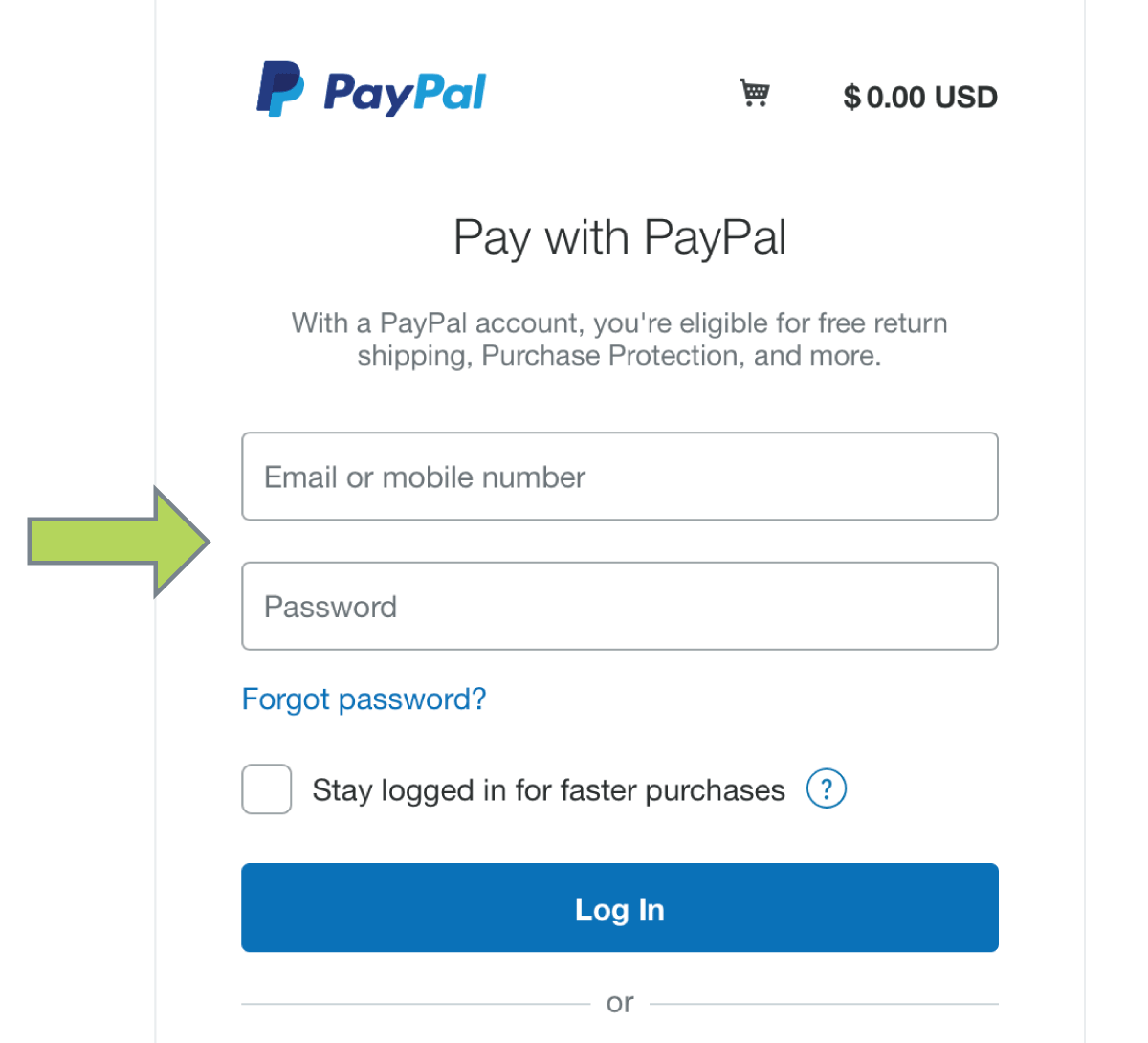

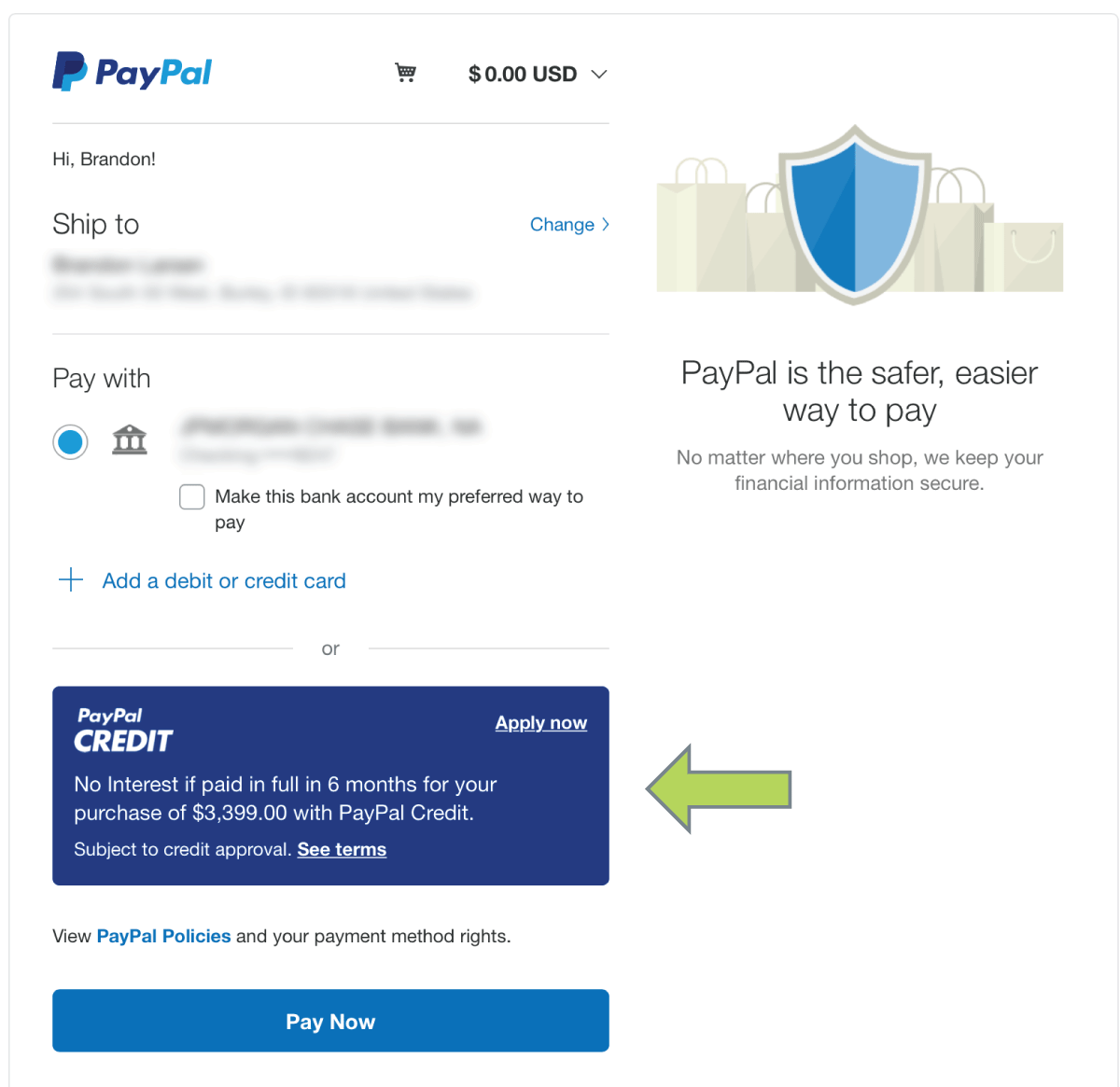

Your specific HSA or FSA plan may also have particular rules about equipment purchases, reimbursement processes, or documentation requirements. Flex handles the Letter of Medical Necessity, but your plan administrator manages your account and processes claims according to their specific procedures. Most HSA and FSA plans follow similar guidelines since they’re all governed by the same IRS regulations, but checking with your specific plan administrator about their equipment purchase policies provides clarity before you commit to a large transaction.

Critical FSA Deadline Information

If you have a Flexible Spending Account, December 31st typically marks the use-it-or-lose-it deadline for your funds. According to the Employee Benefit Research Institute, more than half of FSA account holders forfeit funds each year, with average forfeitures reaching $441. That’s money that could have purchased fitness equipment qualified for medical necessity instead of disappearing unused.

FSA plans operate differently than HSA plans in this critical way. While Health Savings Accounts allow you to carry funds forward indefinitely and apply for reimbursement years later, most FSA plans require that purchases be made during the coverage period. Some FSA administrators offer grace periods of up to 2.5 months or allow carryover of up to $610 to the following year, but your specific plan determines these options. Check with your FSA administrator before year-end to understand your deadlines and avoid forfeiting funds.

If you’re approaching your FSA deadline with unused funds, commercial-grade fitness equipment represents a legitimate way to use those dollars for genuine health infrastructure rather than losing them. The combination of approaching deadlines and 30% tax savings creates a compelling reason to make equipment purchases you’ve been considering before your coverage period ends. Through 3G Cardio’s partnership with Flex, the entire qualification and purchase process happens quickly enough to meet year-end deadlines when you act before the final weeks of December.

Equipment Quality and Medical Use Qualification

When a healthcare provider prescribes fitness equipment for someone managing obesity, diabetes, cardiovascular disease, joint issues, or similar conditions, they’re prescribing medical intervention tools, not recreational toys. Equipment rated for 400 pound capacity with motors and frames built to handle sustained daily use demonstrates the kind of serious construction that supports legitimate medical use cases. This is where commercial-grade construction becomes relevant from a compliance perspective, not just a durability perspective.

Treadmills, recumbent bikes, upright bikes, ellipticals, stair steppers, and vibration training platforms all qualify when prescribed for medical necessity. The key factor isn’t the equipment type; it’s whether the equipment serves a legitimate medical purpose as determined by a healthcare provider through the Letter of Medical Necessity process. General recreational fitness equipment purchased purely for aesthetic goals typically won’t qualify, while equipment prescribed for managing specific health conditions generally does qualify when properly documented.

Commercial-grade equipment built to 400 pound capacity with lifetime frame warranties, substantial motors, and proper ergonomic design costs more initially than consumer-grade alternatives because the engineering and component quality genuinely differ. However, this level of construction demonstrates the durability and capability that healthcare providers look for when prescribing equipment for medical use. The fact that commercial-grade construction also supports HSA and FSA eligibility by demonstrating genuine medical-use capability creates a useful alignment of engineering quality and healthcare compliance.

Planning Your HSA or FSA Equipment Purchase

If you’re considering using HSA or FSA funds for fitness equipment, several strategic timing considerations can maximize your tax advantage. For FSA account holders approaching the December 31st deadline, acting before mid-December ensures you have time to complete the health questionnaire, receive your Letter of Medical Necessity, and process the transaction before your funds expire. Grace periods and carryover provisions vary by plan, so confirming your specific deadlines prevents last-minute complications.

For HSA account holders, timing flexibility allows you to plan purchases around when you receive your Letter of Medical Necessity and when equipment fits your broader health management strategy. Since HSA funds don’t expire and you can apply for reimbursement years after purchase, you have more latitude in timing decisions. However, the immediate 30% tax savings from using pre-tax dollars rather than post-tax income applies regardless of when you make the purchase.

Understanding what documentation you’ll receive helps set proper expectations. Flex provides an itemized receipt showing your purchase details and a Letter of Medical Necessity from a licensed healthcare provider explaining why the equipment qualifies as medically necessary for your specific health conditions. Keep both documents together in your records. If you’re using the reimbursement method rather than direct HSA or FSA card payment, you’ll submit both documents to your plan administrator according to their specific claim procedures.

Maximizing Your Healthcare Dollars

The 30% average tax savings from using HSA or FSA funds represents money that would otherwise go to federal income tax, state income tax, Social Security, and Medicare deductions. For someone in the 30% tax bracket purchasing $4,000 of fitness equipment, that’s $1,200 staying in your account rather than going to taxes. When you combine this immediate tax advantage with equipment that doesn’t require ongoing subscription fees to access basic functionality, the long-term value equation becomes substantially more favorable.

Over a 10-year equipment lifespan, avoiding $45 monthly subscription fees saves $5,400. Add that to the initial $1,200 tax savings from using HSA or FSA funds, and you’re looking at $6,600 in total advantage compared to buying consumer-grade equipment with post-tax dollars and then paying subscriptions to actually use it. These aren’t promotional discounts that expire; they’re permanent structural advantages from understanding how to use available healthcare funding mechanisms effectively.

Commercial-grade construction matters because equipment that’s supporting your cardiovascular health, managing your diabetes, facilitating your joint rehabilitation, or enabling your mobility needs to function reliably for years without degradation. Treadmills that develop belt slippage, bikes with seats that cause discomfort after 20 minutes, or ellipticals that wobble under load discourage consistent use. Equipment you actually use because it works properly delivers the health outcomes that justified the HSA or FSA purchase in the first place, creating real return on your healthcare investment beyond just tax savings.